Last week, I had the chance to attend Finextra’s Financial Cloud Summit in London, which was all about sharing best practices when it comes to financial organisations leveraging cloud technologies to better serve their customers.

Cloud has been around for quite some time now, and we’ve been helping many Financial Services (FS) companies with their digital transformation journey, especially with regard to cloud adoption, but we are still seeing companies fail, or at least not taking an optimal path to transformation, which results in wasted time and resources. The different presentations at the conference made me, once again, realise that some organisations should simply go back to basics to succeed in the cloud. So, what are these basics that transpired at the event?

Do Your Homework

Customer digital expectations are changing at a rapid pace: they want reliable, efficient, and trustworthy products and services, delivered quickly, and customisable. For instance, I was recently shocked by how fast I was able to open a Chase account; it only took a couple of minutes (could have been seconds if my passport picture was of better quality – or maybe the machine bugged because of my receding hairline…). I now know the art of the possible, and my expectations are set quite high, so my traditional bank will have to up its game fast if it wants to keep my humble business.

It is clear that technology, and particularly cloud computing, is an (maybe the) answer to enable quick launch, and adoption by your customers, of digital products and services. However, simply moving your IT estate from on-premises to the cloud will not magically allow you to become the next digital challenger. So, there is some thinking to do, and strategising your migration is key.

A good strategy should start with clearly defined outcomes. OK, you want to go to the cloud, but why? What do you want to do in there? What exactly do you want to achieve for your customers? Answering these questions will help you realise that maybe, you won’t need to go all-in (“I want everything in the cloud in two years!”) and some of your applications and workloads can stay as they are whilst others will require more attention. And that way, you can start planning accordingly and allocate your skills and resources in the right places, whilst still delivering value to your customers. The cloud is a significant beast that requires strong skills and knowledge to tame, but as I said earlier it’s been around for a while, and there are plenty of organisations that can educate you on best practices, so don’t hesitate to seek support to help you define or validate your homework.

Beware of the Regulation

It is no surprise that the FS sector is so heavily regulated, and for good reasons that don’t need to be addressed today. But we’ve seen many organisations trying to transform their technology and adopt the cloud, without giving enough attention to the regulatory and security requirements or giving it too late.

Financial institutions are responsible for safeguarding large amounts of money and sensitive customer information – that won’t change – but the way you manage this in the cloud adds complexity and requires brand-new skills.

The regulatory ecosystem in the UK is quite complex, and there are many plates to spin and several bodies to please to ensure compliance: they include the financial regulatory and supervisory authorities, the standards-setting bodies, your third-party providers, just to name a few… Talking to these entities and taking them on the journey with you from the start is key to success. You do not want to plan your migration, set up tight deadlines, sign contracts with your Cloud Service Provider (CSP), start ramping up resources, to suddenly realise that one of the authorities needs six months to review a report…

And I cannot stress this enough: security in the cloud is different from on-premises security. I’ve just typed those words on Google and came up with 376 million results, so that must be true. And no, your CSP will not take care of everything. But everyone knows that, and still, the media is full of data breach stories (and that’s just the ones we hear about). So I’m not going to flog a dead horse here; just be sure that your organisation intrinsically understands every single part of the shared responsibility model, and if you’re not 100% confident with one (or several) parts of it, speak up. Do not wait to be the next story in the news.

Cool Tech Attracts Talent

Another thing that was made clear during the event, is that the talent pool in the UK is not unlimited. And if your organisation doesn’t start doing cool stuff with cool technologies, they will not be appealed by your offering and will join your competitor who’s all cloud-native and has adopted the whole suite of modern ways of working. And why shouldn’t they? No one likes fighting fires all day or having to constantly go through tedious governance and approval processes to write two lines of code, or wasting precious time reinventing the wheel every time someone wants to develop a new product.

No, people want transparency from day 0 (the first interview) on what your IT transformation plans are, and the technology stack they’ll be playing with. They want to know that you have implemented a product-led approach, which will allow them to try and fail fast without fear because that doesn’t cost you much, and they want to work in an environment where automation is widely adopted so they can focus on why you brought them in: developing cool digital products and services that create value to you, and your customers.

On the other hand, adopting modern cloud technologies doesn’t mean you have to get rid of your existing workforce if they don’t fit the bill. Revising your operating model is the first step (which is often overlooked) and will allow you to take care of the most important asset of your organisation: your people. The tech wouldn’t work without them. People might be reticent to change, but they’ll be more reticent to lose their job. Enablement is the key. Make it easy for them to learn new skills and widely express your transformation plans, as early as possible. Take them on the journey with you. Someone at the event made an interesting analogy when discussing Artificial Intelligence: if you don’t jump on the AI boat now, you’ll never catch up. I’ll take this analogy a bit further: if you don’t have engineers or rowers, your boat won’t go far either.

In Summary

There are so many more interesting things we could have covered in this article, but these three themes stuck out to me during the conference.

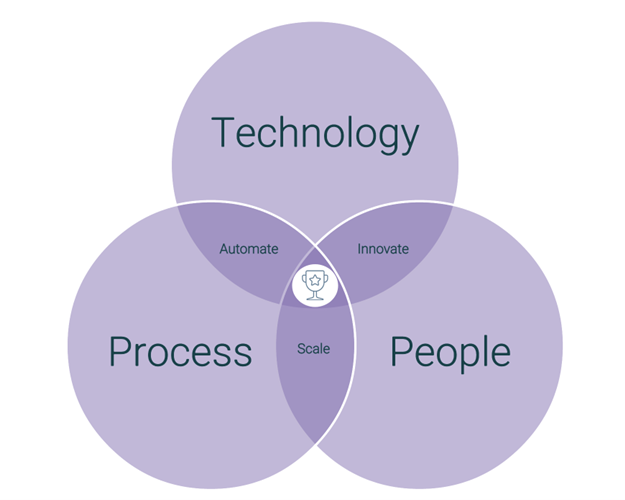

Namely that a cloud migration must be a well-thought endeavour especially if a FS organisation wishes to leverage the benefits that the cloud can offer. These benefits are difficult to extract, so getting it right from the start is critical. They will be near impossible to achieve if you don’t rethink your security and your approach to regulation. And you must take your employees on the journey and revise your operating model. It’s not just about the tech. A complete transformation involves evolving your processes and your people, and since a picture speaks a thousand words, I’ll leave you with this one:

Do you want to win the cloud race? Get in touch.